How Much Does Inventory Carrying Cost?

May 26, 2025 By Rick Novak

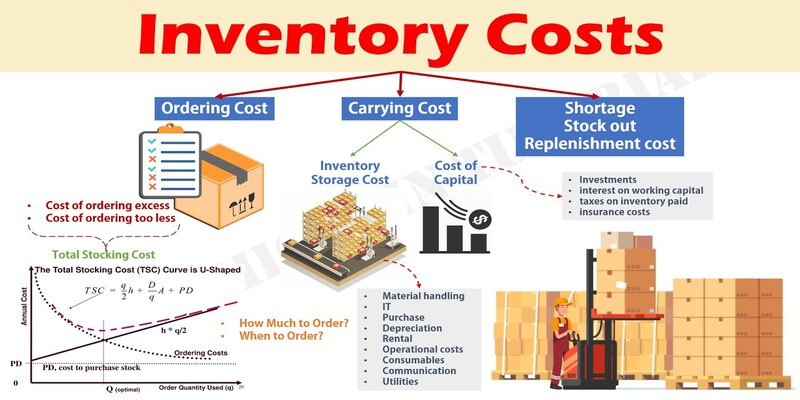

What Is Inventory Carrying Cost? Inventory carrying cost is an essential factor for businesses that maintain inventory. It is the cost that a company incurs to keep inventory in stock. Inventory carrying cost includes both direct and indirect costs. Direct prices include storage, handling, insurance, and taxes, while indirect costs include obsolescence, theft, and depreciation costs. Businesses must closely monitor inventory carrying charge to ensure it stays manageable. If inventory carrying cost is too high, it can impact the business's profitability. Therefore, it is essential to understand the components of inventory taking charge, the factors affecting it, and ways to reduce it.

Components Of Inventory Carrying Cost

Inventory carrying cost comprises several components, including storage, handling, insurance, taxes, obsolescence, theft, and depreciation costs. These components can vary depending on the type of inventory being stored and the industry in which the business operates. Storage costs refer to the expenses associated with holding stock, such as rent, utilities, and maintenance costs. Handling costs refer to the fees associated with moving inventory within the storage facility, such as labor, equipment, and material costs. Insurance costs are those associated with insuring inventory against loss, damage, or theft. Taxes refer to the costs associated with inventory taxes imposed by local or state governments.

Examples Of Inventory Carrying Cost

Inventory carrying cost varies depending on the industry in which the business operates and the type of inventory being stored. For example, a company that sells perishable goods, such as food or flowers, may incur higher obsolescence costs than a business that sells durable goods, such as furniture or electronics. One example of inventory carrying cost is the storage cost of a company that rents a warehouse to store its list. Another example is the handling cost of a business that hires employees to handle its inventory. Insurance costs are those associated with insuring inventory against loss, damage, or theft. Taxes refer to the fees related to inventory taxes imposed by local or state governments. Obsolescence costs refer to inventory expenses becoming obsolete, expired, or outdated. Theft costs refer to the fees associated with merchandise being stolen or lost.

Factors Affecting Inventory Carrying Cost

Several factors can affect inventory carrying cost, including the type of inventory being stored, the storage facility's location, the storage duration, and the demand for the product. The kind of inventory being stored can affect list carrying costs because some stock is more expensive to keep than others. For example, perishable goods may require refrigeration, increasing storage costs. The location of the storage facility can also affect inventory carrying charges because different areas may have additional storage costs and taxes. The duration of storage can also affect list-bringing costs because more extended storage periods may result in higher storage costs and depreciation costs. The demand for the product can also affect inventory carrying charge because high demand may require higher inventory levels, which can increase storage and handling costs.

How To Calculate Inventory Carrying Cost

Inventory carrying costs can be calculated by adding up all the direct and indirect costs of holding inventory. The formula for calculating inventory carrying cost is:

Inventory Carrying Cost = Storage Cost + Handling Cost + Insurance Cost + Tax Cost + Obsolescence

Ways To Reduce Inventory Carrying Cost

Reducing inventory carrying costs is essential for businesses wanting to increase profitability. Here are some ways to reduce inventory carrying costs:

- Implement Just-in-Time (JIT) inventory management: JIT inventory management involves keeping inventory levels as low as possible by only ordering inventory when needed. This approach can reduce storage costs, handling costs, and obsolescence costs.

- Optimize inventory levels: Optimizing inventory levels involves finding the right balance between keeping enough inventory to meet customer demand and not holding too much stock that will increase storage and handling costs.

- Improve inventory accuracy: Improving inventory accuracy can reduce obsolescence costs by ensuring that inventory is not lost, misplaced, or expired.

- Implement inventory tracking systems: Inventory tracking systems can help businesses track inventory levels, identify slow-moving inventory, and reduce theft costs.

- Negotiate with suppliers: Negotiating with suppliers for better prices, terms, and delivery schedules can reduce inventory costs by allowing businesses to order smaller quantities more frequently.

- Improve supply chain management: Improving supply chain management can reduce lead times, reducing the amount of inventory businesses need to keep in stock.

- Dispose of obsolete inventory: Disposing outdated merchandise can reduce obsolescence costs and free up storage space for more profitable stock.

Conclusion

Inventory carrying cost is an essential factor for businesses that maintain inventory. It includes direct and indirect costs and can impact the business's profitability if it becomes too high. Companies can reduce inventory carrying charges by implementing JIT inventory management, optimizing inventory levels, improving inventory accuracy, implementing inventory tracking systems, negotiating with suppliers, improving supply chain management, and disposing of obsolete inventory. Reducing inventory carrying costs can increase profitability, cash flow, flexibility, and customer satisfaction.

Best Wells Fargo Credit Cards

Definition, Term, and Transaction Date of Credit Card Posting

Difference Between Series EE and Series I U.S. Savings Bonds

Settling-In Allowance: What is it?

Teaching your kids about financial literacy doesn't have to be boring. Here are some creative ways to use games to make learning fun for your children.

Ways to Make Walmart Credit Card Payment

Warren Buffett's Investment Strategy and Approaches

Where In The United States Is Best To Purchase A Winter Home?

Municipal Bonds vs. Taxable Bonds and CDs: How Do They Compare?

What are the 401(k) Plan Contribution Limits?

Buying a Home: The Difference Between Cash vs. Mortgage